Bitcoin is an energy efficient technology that drives innovation and development of environmentally sustainable infrastructure for payment networks and data processing systems.

Bitcoin extracts energy efficiency through both the software implementation and the physical infrastructure on which it runs. The competitive nature of block reward mining forces miners to extract increasingly greater efficiencies. Bitcoin has, for example, driven recent innovations in immersion cooling solutions for data centres. These improvements in immersion cooling have subsequently been repurposed for other sectors, such as reducing the energy consumption of GPU intensive AI workloads. Bitcoin is directly responsible for spawning this and many other innovations in energy efficiency.

Notwithstanding Bitcoin’s contribution to the environment, it has been criticised for having a negative effect:

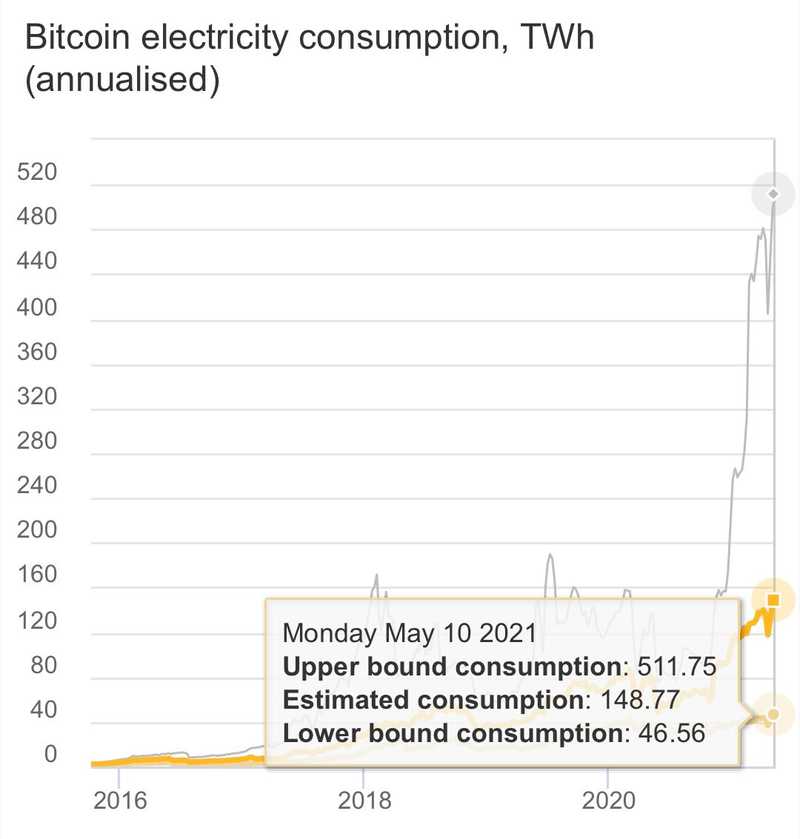

Elon Musk, in May 2021, tweeted a graph of bitcoin's power consumption and lamented that the "… energy usage trend over past few months is insane." Musk subsequently announced that Tesla would no longer accept Bitcoin as payment for its electric cars. Musk’s position on Bitcoin makes sense. Bitcoin tends towards optimal energy efficiency over time, but, in the short term, it may not be implemented efficiently by those who operate the network.

Bitcoin currently consumes 345kWh per transaction. VISA, on the other hand, consumes only 0.0015 kWh per transaction. To make matters worse, many block reward miners operate in countries that allow energy providers to emit unnecessary pollutants.

The maintainers of Bitcoin’s source code, and the miners who run the software, will eventually change their approach or they will be outcompeted and cease to be part of the Bitcoin network.

The temporary aberration in Bitcoin’s energy consumption profile will be resolved. An often touted solution is the Lightning Network, which migrates transactions off chain and uses the main chain as a settlement layer. This is often referred to as a layer-2 solution because most transactions run on a second overlay network. The Lightning Network is under development, and, if successful, will allow Bitcoin to operate more efficiently than traditional payment networks. Nothing is guaranteed however. Elon Musk trolled in a tweet: “Are any money transmitter or other licenses needed to use this [the lightning network] in USA?”. Musk was highlighting the threat of the Money Transmitter Act (MTA), which requires providers of money-related services in the U.S. to secure a money transmission license from the State Banking board. The underlying Bitcoin layer is exempt because it runs on a public ledger, but regulators could deem it illegal to operate a Lightning Network node without a money transmission license.

Bitcoin will become increasingly energy efficient even if the Lightning Network fails. Let's say it fails to navigate the regulatory risks, or it fails technically. Another solution will be found. There is, for example, an approach that reduces Bitcoin’s energy consumption per transaction, which is currently running production workloads. Elon Musk, in a June 2021 interview said that you can take the layer-one solution “... further than people realise”. Musk suggested that the exchanges could assist in the solution, but even without the exchanges layer-1 becomes more efficient with larger blocks. The energy required to solve the compute-intensive hash puzzle for a block is independent of the block size, which means that larger blocks allow more transactions to be processed for effectively the same amount of energy. In this way, Bitcoin’s energy efficiency is roughly proportional to the block size (all other things being equal).

There's no consensus regarding the viability of the Lightning Network, the correct block size, or any other initiative in the space. Luckily, one of the features built into Bitcoin’s design is that it can fork whenever disagreements arise. Miners choose which fork to follow, and they needn't choose the same fork. Bitcoin has forked many times, leading to BTC among others. One of the competing Bitcoin forks is already processing multi-gigabyte blocks at scale, which are thousands of times more energy efficient than the 1MB blocks of BTC. The fierce competition between forks is another way in which Bitcoin drives energy efficiency.

Energy efficiency is also a function of price. The Bitcoin protocol includes a difficulty factor that adjusts automatically to ensure that roughly one block is processed every 10 minutes. If the number of transactions remain low the price will eventually drop and force the least efficient miners off the chain. This will cause an automatic reduction in mining difficulty, and less energy consumption. This is another way in which Bitcoin ensures its own efficiency.

The economics of Bitcoin demand energy efficiency from its operators, leaving them with no choice but to minimise the amount of energy consumed per transaction. This can be achieved by more efficient cooling systems, by layer-2 solutions such as the Lightning Network, by layer-1 solutions such as increasing the blocksize, or by any means necessary. It is irrelevant from the perspective of both miners and consumers how efficiencies are achieved - only that they are achieved. Miners care about profit, and consumers care about utility & low fees, all of which demand increased energy efficiency. Inefficient miners will be outcompeted over time, and inefficient forks will be driven to extinction as miners and consumers converge on the optimal implementation. The relentless competition built into Bitcoin’s design makes it probable that Bitcoin will become the most energy efficient payment and data processing platform in the world.